Resources

“100 percent of body shops and OEMs to invest in AI”: AI fueling the future of automotive claims?

Automated digital-first channels are the new benchmark for a consumer’s optimized claims journey. To meet the demand for digital convenience and solve critical operational challenges, providers are investing in Artificial Intelligence (AI) at speed and scale. AI has now moved beyond its status as an initial trend and has quickly become the driver of innovation across insurance claims architecture. In fact, McKinsey & Company1 predicts that by 2030, more than half of the current claims activities will be replaced by AI-enabled automation.

DIGITAL-FIRST DEMAND SHIFTS CLAIMS PROCESSES INTO 6TH GEAR

Digital has never been more integral to the everyday transactions we all take for granted. With a touch of a smartphone button, an Uber can be summoned to the doorstep. Fast food, groceries, specialist personalized items, and online shopping services are at our fingertips ready to meet our needs. So it’s no surprise to see that digitization is now also a fully integrated and expected part of the claims process.

Solera examines consumer assumption of AI-generated claims and the demand for digital-first providers.

ARTIFICIAL INTELLIGENCE (AI) IS THE FUTURE OF THE AUTOMOTIVE CLAIMS JOURNEY

SOLERA INNOVATION INDEX 2022: THE DEFINITIVE GUIDE TO DIGITAL TRANSFORMATION ACROSS THE GLOBAL AUTOMOTIVE CLAIMS ECOSYSTEM.

Automated digital-first channels are the new benchmark for optimized claims journeys. Providers are implementing AI at speed and scale to meet the demand for digital convenience and solve critical business challenges.

Solera’s Intelligent Estimating helps the industry to combat inflation through improved repairability

Solera’s Intelligent Estimating helps the industry to combat inflation through improved repairability

- The broader impact of the pandemic was compounded by rising inflation, fuelling the cost of parts

- PZU’s successful rollout of Intelligent Estimating delivers early successes, including significant improvements in part repairability per claim

- AI-based estimating standardizes damage appraisals, overcomes skill shortages, optimizes parts replacement and reduces carbon emissions

The collision repair industry continues to weather the ongoing repercussions of the pandemic, with skill shortages and scarcity of repair parts impacting cycle times and productivity. These challenges have been compounded by global inflation, compelling businesses to explore innovative tech solutions to offset these issues.

Insurers are recognizing the impact of next-generation technologies and the benefits of driving AI adoption in critical areas. Solera’s Innovation Index 2022 survey indicated how insurers ranked the return from digital transformation projects, with 55 per cent welcoming faster decision making and the ability to increase staff productivity. *

PZU benefits from adopting AI in workflow

Among the first to benefit from new tech was PZU, a pioneering Polish insurer that implemented AI in its estimating workflow. Since July 2021, its assessors estimated losses in over 45,000 claims assisted by Solera’s AI solution. Powered by the latest image processing technology, Qapter® Intelligent Estimating detects damage type and severity from vehicle images (taken by the driver or damage appraisers), producing a preliminary estimate ready for review in under three minutes.

Beyond saving time, AI-based estimating is helping insurers standardize the quality of estimates and overcome skillset shortages: “Qapter Intelligent Estimating helps unify and accelerate the inspection process across the entire country whilst resolving its growing skills gap. It takes considerable time to train damage appraisers, and retention of qualified people is becoming increasingly challenging. Thanks to Qapter, we are making our people more productive and helping our less experienced team members to ramp up their skills faster…” said Robert Zielonka, Director of Technical Claims Settlement for PZU. “By using the AI estimate as a second opinion, loss adjusters feel more confident about their work.”

Combatting inflationary costs

With ongoing supply chain challenges and inflation set to reach 7.4 per cent globally, the cost of parts replacement is putting additional pressure on motor claims. Marcos Malzone, VP, Product Marketing, Solera commented**: “As the average cost to replace parts makes up to 70% of the repair estimate, every effort to optimise repair opinions can help the industry to manage costs and reduce cycle times. For example, we estimate that insurers in Poland could save around 10 million USD annually for every percentage point improvement in repairability. Likewise, PZU has seen how Intelligent Estimating has helped improve repairability of parts, crucial to managing costs and reducing global carbon emissions.”***

Lowering carbon emissions

As the automotive industry embraces the global effort to reduce carbon emissions to 80% by 2050, the collision repair industry is looking for ways to contribute and meet its ESG objectives. According to research published in 2018 by the International Journal of Automotive Engineering (IJAE)****, the average CO2 generated in Japan when replacing an external body part is about 1.125 kilograms. With an estimated 2.5 million parts replaced in the Polish market every year, the introduction of AI estimating has the potential to save over 2 billion tons of CO2 every year.

Future-proofing the road ahead

Digital adoption within industries has been accelerated by COVID-19. A recent report by McKinsey suggests companies have increased their share of digital or digitally enabled products in their portfolios by 7 years and by 10 years in developed Asia. During the pandemic, many companies have refocussed their offerings rather than making huge leaps in product development in the span of a few months. However, respondents expect these changes to be long-lasting.*****

This view is matched by Solera research, with global car insurers seeing the true value of accelerating AI adoption. 100 per cent of insurers surveyed are planning to invest in AI InsurTech software in the next 12 months. Marcos Malzone added: “Alongside the need to manage costs and time efficiencies, 46 per cent of insurers regard the customer experience as a key driver for implementing AI. More and more consumers desire a fully automated AI claims and repair experience with two-thirds of consumers prepared to switch insurers for a faster digital experience. ****** We remain a tech organisation and will continue to innovate our solutions with a key focus on AI to help customer future-proof their businesses whilst continuing to deliver a seamless end-to-end online experience for policyholders.

To learn more, visit www.qapter.com.

* EN-Qapter AI infographic assessor-2022 Solera in partnership wth Coleman Parkes surveyed over 2,000 consumers, OEM’s, dealers, repairers and insurers

**Worldwide Inflation by Country 2022 (inflationdata.com)

*** Solera Internal Data, July 2021- June 2022

**** International Journal of Automotive Engineering, July 2018

*****COVID-19 digital transformation & technology | McKinsey .

******Solera Innovation Index 2022 infographic (qapter.com)

SOLERA SURVEY REVEALS SURGE IN TRUST AND ADOPTION OF AI-DRIVEN CLAIMS AND REPAIRS AS PROVIDERS BATTLE GLOBAL ECONOMIC UNCERTAINTY

Solera Survey Reveals Surge in Trust and Adoption of AI-Driven Claims and Repairs as Providers Battle Global Economic Uncertainty

Westlake, Texas, April 26, 2022 – New global market research released today by Solera Holdings, LLC (“Solera”), the global leader in vehicle lifecycle management, reveals the increasing demand for digital-first automated claims, with trust in AI-driven claims and repairs soaring to 79% globally. The annual survey also identifies rapid acceleration of AI adoption among global car insurers, enterprise body shops and Original Equipment Manufacturers (“OEM”) dealer networks to deliver on consumer expectations.

Digital-first channels are revolutionizing how claimants manage their motor claims and repairs. Half (49%) of consumers now desire fully digital self-serve experiences and 43% prefer a hybrid model blending digital tools with human contact. As a result, more consumers are now willing to change their insurance provider to one that offers digital claims technology (70%) and nearly two thirds (65%) would choose a repairer using AI to minimize the risk of error when conducting work on their vehicle.

“Digitization is now an integral and expected part of the claims cycle. Our research shows the pace at which consumers now actively seek automated self-serve models that meet their needs for digital convenience, speed, and accuracy,” said Bill Brower, VP Industry Relations, Solera. “It’s clear that those implementing cutting-edge technologies like AI will gain critical customer retention, efficiency, and resilience.”

Digital transformation projects have been fast tracked to optimize processes and solve challenges accelerated by the global pandemic. In the last year, repair shops and OEMs saw the highest return on projects through improved profitability (52%), increased staff productivity (50%) and employee efficiency (49%). Insurers saw the highest return on digital transformation projects through improved business resilience (58%), faster decision-making (55%) and increased staff productivity (55%).

In line with this shift, the use of digital claims technology has also increased rapidly. Solera’s survey revealed over a third of claimants have now completed a motor claim without speaking to a person and over half have taken images of their vehicle and uploaded them onto an insurer’s platform.

Despite the progression of AI-driven claims and repairs, this ecosystem is still facing critical adoption barriers. Global car insurers continue to cite cost to implement and upskilling the workforce (73% and 65% respectively) as their biggest AI challenges. Repair shops and OEMs face similar drawbacks, as cost remains the largest barrier to AI (75%), up by a third year-on-year. However, there is a clear path for future AI investments. Now, nearly two thirds (64%) of global car insurers and 43% of repair shops and OEMs are highly confident their AI goals will be met within the next 12 months, ranking 8 out of a maximum 10.

“Covid was clearly the tipping point for customer adoption of digital services. Insurance customers are clearly ready for digital options especially when they have the opportunity to quickly access an adjuster in person as needed. The optimism among industry decision makers to achieve AI objectives is a huge vote of confidence, but more needs to be done to realize its value for stakeholders and customers. There are inevitable barriers in the journey towards full automation, but the message is clear. Now more than ever, organizations must leverage first-class technology partnerships to streamline this transition and maximize the return on AI investments,” added Brower.

For more information and findings click here.

About This Research Survey: Solera’s research series was conducted by Coleman Parkes in November-December 2021 with 1,500 tech-savvy consumers and senior decision makers from over 500 global car insurance companies, enterprise body shops and OEM dealer networks across North America, Europe and Asia Pacific.

About Solera

Solera is the global leader in vehicle lifecycle management software-as-a-service, data, and services. Through four lines of business – vehicle claims, vehicle repairs, vehicle solutions and fleet solutions – Solera is home to many leading brands in the vehicle lifecycle ecosystem, including Identifix, Audatex, DealerSocket, Omnitracs, LoJack, Spireon, eDriving/Mentor, Explore, CAP HPI, Autodata, and others. Solera empowers its customers to succeed in the digital age by providing them with a “one-stop shop” solution that streamlines operations, offers data-driven analytics, and enhances customer engagement, which Solera believes helps customers drive sales, promote customer retention, and improve profit margins. Solera serves over 300,000 global customers and partners in 100+ countries. For more information, visit www.solera.com.

Media Contact: soleraPR@jargonpr.com

Solera: Amy Casas: amy.casas@solera.com

SOLERA HOLDINGS: AUTOMATING THE CLAIMS WORKFLOW FOR DRIVERS, INSURERS, AND TECHNICIANS

Solera Holdings uses Google Cloud artificial intelligence and machine learning to develop Qapter®, a touchless intelligent solution for the entire vehicle claims cycle. Image data from real claims drives consistently faster and more accurate cost and time estimates for drivers, insurers, and technicians.

TURNING AUTOMOTIVE BREAKDOWNS INTO AN AI BREAKTHROUGH

“Hello, claims department? I need to get my car fixed. Fast.”

Just about anyone who drives knows what it’s like. A fender bender, a broken windshield, or something more serious. Having a car out of commission for repairs can ruin a workday, a special occasion, or worse. Waiting for a claims adjuster and negotiating costs and insurance deductibles is complicated and time-consuming as well. Who hasn’t thought, “There has to be a better way”?

Solera Holdings, the market leader in the automobile damage estimation business, thought so too. Since 2005, the company has been transforming the way insurance and automotive professionals provide value to their customers. Today, Solera manages 300 million transactions between insurance companies, drivers, and the automotive industry every year, representing about 60 percent of all claims worldwide. With an impressive database of proprietary damage claims images and payments, the company realized that it had just what it needed to take advantage of an artificial intelligence (AI) and machine learning (ML) solution to process touchless claims. Solera launched Qapter in 2020, using Google Cloud AI/ML products, including Google Kubernetes Engine, TensorFlow, Cloud GPUs (graphics processing units), Cloud TPU (Tensor Processing Unit), machine learning APIs, and continuous integration and delivery products such as Cloud Build and Cloud Run to power an end-to-end claims management system that gets cars fixed and claims paid—fast—and without human mediation.

“Insurance companies had encountered a number of challenges in trying to commercialize computer vision solutions. They would do their research projects, and could usually build a working solution in-house, but they couldn’t scale. What we learned from this is the importance of building a productized solution in order to avoid failing as an AI project.”

—Marcos Malzone, VP Product Management, Solera Holdings

Matching technology to the problem at hand

When Chief Technology Officer Evan Davies joined Solera in 2020, he had already been working with AI for many years. Experience had taught him that no one particular AI technology could solve every business problem, no matter how innovative or disruptive it might be. Evan knew that a combination of multiple technologies sourced in-house and from cloud vendors would be required. He was determined that Solera would effectively apply mature AI technologies to gain and maintain competitive advantages for the business. To his delight, he joined a team that had already figured out the best approach to the problem they had identified—how to use AI and ML to automate Solera’s existing automobile collision claim workflow.

Solera’s product team knew from talking with insurance companies over several years that they needed an automated claims process. Quite a few insurers had tried to use computer vision to automate the collision damage repair process. Marcos Malzone, VP of Product Management at Solera EMEA, explains, “Insurance companies had encountered a number of challenges in trying to commercialize computer vision solutions. They would do their research projects, and could usually build a working solution in-house, but they couldn’t scale. What we learned from this is the importance of building a productized solution in order to avoid failing as an AI project.”

Solera had focused on the most elegant application of AI to the workflow, which was to effectively identify vehicle damage. The initial damage assessment step was transformed into an AI-powered process, and the addition of ML leveraged the company’s huge existing database of claims images and repair information to offer precise method, cost, and time estimates for repairs. Equally important to the success of the solution was the choice not to complicate the process by changing the company’s tried and true backend systems. Davies says, “We wanted to solve a specific problem by applying AI to identify collision damage and then use our backend systems and machine learning to create a plan for how to repair that damage.”

Solera had built a previous version of an automated claims system that showed the promise of what a next-generation solution could be. The team’s original vision combined with the latest cloud and AI technologies would enable Solera to reimagine Qapter using AI and ML.Through extensive research, the Solera team had already advanced development to the point where they had eliminated several less successful approaches. All they needed was the right AI solution coupled with the latest cloud technologies to explore new ideas and upgrade Qapter. This next-generation version would streamline the estimation process for Solera customers and vehicle owners worldwide.

“There’s a transformation going on at Solera toward building core competencies that can be leveraged across the company, becoming game-changers in more than just one area. Google Cloud isn’t just a spot solution, it’s a core competency for us.”

—Evan Davies, Chief Technology Officer, Solera Holdings

Unlocking possibilities for product development with Google Cloud

The Solera team were already sophisticated cloud technology users when they decided to look for an AI/ML solution that would integrate with a full suite of cutting-edge cloud technologies. Although the company hosts its own data lake in order to maintain contractual agreements with customers all over the world, the accident claim workflow was cloud-based. The team knew that choosing the right technology vendor would be key to a successful outcome for the next-generation platform as well as new products in development.

After completing a thorough technology bake-off, Google Cloud’s AI/ML solutions proved to be more sophisticated, robust, and scalable than what other vendors could offer. For Solera, having best-in-class AI technologies that are tightly integrated with the entire Google Cloud portfolio was a decisive factor. These additional capabilities meant that Solera could take advantage of faster processing speed and sophisticated tools that complement its development focus. In short, Google Cloud could provide Solera with everything it needs from a single vendor.

Solera reaped the benefits of a single-source provider by leveraging products across the breadth of Google Cloud. Solera developers were pleased to discover just how quickly Google Cloud technology has evolved and how it offers a highly stable framework for faster, less complex deployment across the value chain. Starting with Cloud Vision for simple image processing, Solera uses the Vision API’s optical character recognition (OCR) to collect license plates and VIN numbers. TensorFlow helps to build custom algorithms and machine learning models for image recognition and extraction of vehicle data, allowing for collection of vehicle make and model, damage information, and parts required. In addition, Cloud GPUs and TPUs allow for accelerated processing of all data models, greatly exceeding the capabilities of traditional central and graphics processing units.

“For drivers, getting into an accident is an unpleasant experience. As data scientists, anything that we can do to make that experience fade more quickly and get people back on the road is our mission.”

—Mihran Shahinian, VP of Data Integration, Solera Holdings

Innovating with solutions, solving problems with technology

Having chosen Google Cloud as the technology enabler for the company’s commercial innovation, the Solera team had a lot to learn in order to make the most of the new platform. Fortunately, they had help from the engineers at Google Cloud as well as the expertise of DoiT International, a Google Cloud Managed Service Provider. From advice on defining the platform architecture to sharing best practices to answering implementation questions on the fly, Solera relies on Google Cloud and DoiT to help leverage its investment. Davies says, “DoiT demonstrated deep knowledge of both Google Cloud and the full-stack infrastructure that Qapter requires.”

Adds Davies, “There’s a transformation going on at Solera toward building core competencies that can be leveraged across the company, becoming game changers in more than just one area. Google Cloud isn’t just a spot solution, it’s a core competency for us.”

Launched in 2020, the new version of Qapter dramatically changes what Solera offers its customers. Once a driver uploads a picture of their vehicle’s damage and starts the claims process, the platform leverages its huge repository of claims images to make an estimate of the extent of the damage, recognize the make and model of the vehicle, know what parts need to be replaced, and how much repairs will cost. All without sending a claims adjuster to physically examine the vehicle. This automates a significant part of the claims processing workflow, benefiting not only insurance companies, but also automotive industry partners and drivers.

Mihran Shahinian, Solera’s VP of Data Integration, leads a team of engineers focused on analytics and data science and is responsible for mining the company’s data for predictive analytics. He explains, “What AI computer vision damage detection does is very similar to the evolution of mobile phone secure access, which, over time, went from PIN code to fingerprint to face recognition.” With computer vision, the technology evolved from repair estimation spreadsheets to 3D models, and now even more touch points have been eliminated. Drivers just need to take a picture of their car, and Qapter does the rest. Adds Shahani, “For drivers, getting into an accident is an unpleasant experience. As data scientists, anything that we can do to make that experience fade more quickly and get people back on the road is our mission.”

Self-service collision claims in the time of COVID-19

Solera’s customers in France and The Netherlands, the two initially deployed markets for Qapter, are thrilled with the platform’s ability to enhance the damage claims workflow by identifying parts and estimating repairs using AI. Qapter has leapfrogged other efforts begun years earlier in this regard. In just a few months since rollout, the system is now able to auto-authorize 50 percent of damage claims, reducing estimating costs by nearly half.

In addition, Qapter is providing an unexpected benefit to stakeholders across the damage claims value chain during the pandemic. Not only does the platform reduce time and costs for drivers, insurers, and auto repair providers, but it reduces human interactions. Helping to ensure social distancing while providing a necessary service means that drivers can get back on the road, repair shops can keep working, and insurance companies can avoid having to send employees out into the field.

“The core value of Qapter is its three-dimensional vehicle models, allowing it to understand how a huge range of individual vehicles are composed,” says Shahini. “We can repurpose this data and put it through different workflows depending on what a given company wants to achieve. One company may use it for vehicle inspection while another might use it for collision estimation. We can also envision a wide range of potential use cases for the future, giving us a solid basis for new product development.”

PHOTO ESTIMATING: THE HOLY GRAIL OF TOUCH-LESS CLAIMS

Businesses around the world have fast-tracked technology adoption, specifically, Artificial Intelligence (AI) and Machine Learning (ML).

According to Gartner, the year 2020 marked the continued democratization of AI and despite the global impact of COVID-19, 47% of AI investments were unchanged and 30% of organizations were planning to increase such investments.

COLLABORATION IN A CRISIS: BUILDING A RESILIENT VEHICLE REPAIR ECOSYSTEM TOGETHER

Continuing collaboration demands a move away from purely transactional relationships across existing networks. Instead, we must shift toward longer, innovation-driven partnerships that will ease points of tension in the workflow and deliver successful claims experiences. Start by considering whether digital can be a vehicle for enablement in your organization’s own operation.

For example, can a digital-led strategy bridge gaps in a disrupted supply chain, or facilitate automated connections between insurers and operational repair sites?

This white paper discusses Solera’s guide to business planning for strengthening relationships to build a safe and connected future.

ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

The insurance and automotive ecosystems currently face a revolutionary business process innovation: harnessing maturing technologies to add considerable value to the digital claims and collision repair process.

This white paper discusses how to unlock significant value by employing a new, modern workflow where the time from initial incident to claims resolution is significantly reduced and the consumer experience exponentially improved.

ACCELERATING DIGITAL TRANSFORMATION FOR THE FUTURE OF AUTOMOTIVE CLAIMS

Digital transformation is not just about disruption or technology. It’s about value, people, optimization and the capability to rapidly adapt when such is needed through an intelligent use of technologies and information.

In this white paper, Solera explores the strategies and technologies that will transform the workflow of today and tomorrow.

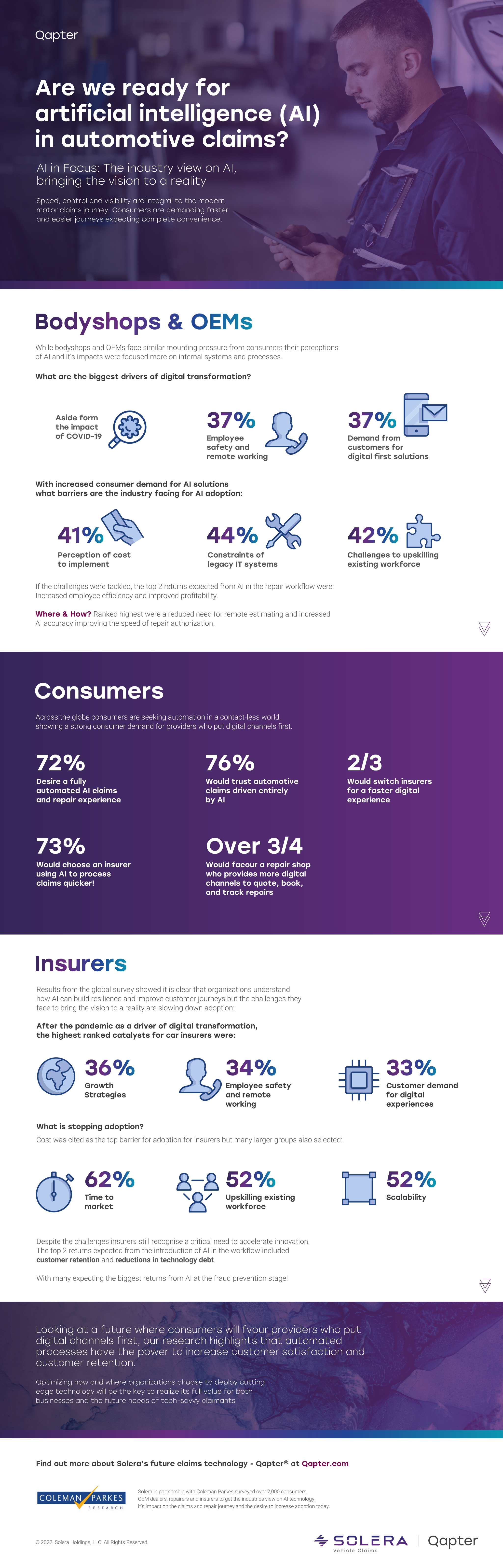

ARE WE READY FOR ARTIFICIAL INTELLIGENCE (AI) IN AUTOMOTIVE CLAIMS?

Looking at a future where consumers will favor providers who emphasize their digital efforts, our research highlights that automated processes have the power to increase customer satisfaction and customer retention. Optimizing how and where organizations choose to deploy cutting-edge technology will be key in providing consumers with easier and more convenient automotive claims.

DELIVERING THE BENEFITS OF AI-POWERED ESTIMATION THROUGH INNOVATION

During the Reuters Future of Insurance Europe virtual conference, Solera’s Regional Managing Director, David Shepherd and Jörg de Groot, Business Process Manager at Schadenet explored how the global crash repair and insurance industries must now do the impossible and drive growth in the face of the largest recession in a generation. Check out the short recording showcasing Qapter and why we at Solera believe photo-based estimation will be the catalyst to enable the acceleration of digitalization, throughout the claims workflow.

LEVERAGE THE POWER OF DATA AND REPAIR SCIENCE™

With Qapter, the true power of the data driven intelligent claims process is now here. The breadth of unique automotive and vehicle data paired with proven repair science provides deeper insights and smarter processes to streamline the claims workflow. More data allows you to make better decisions.